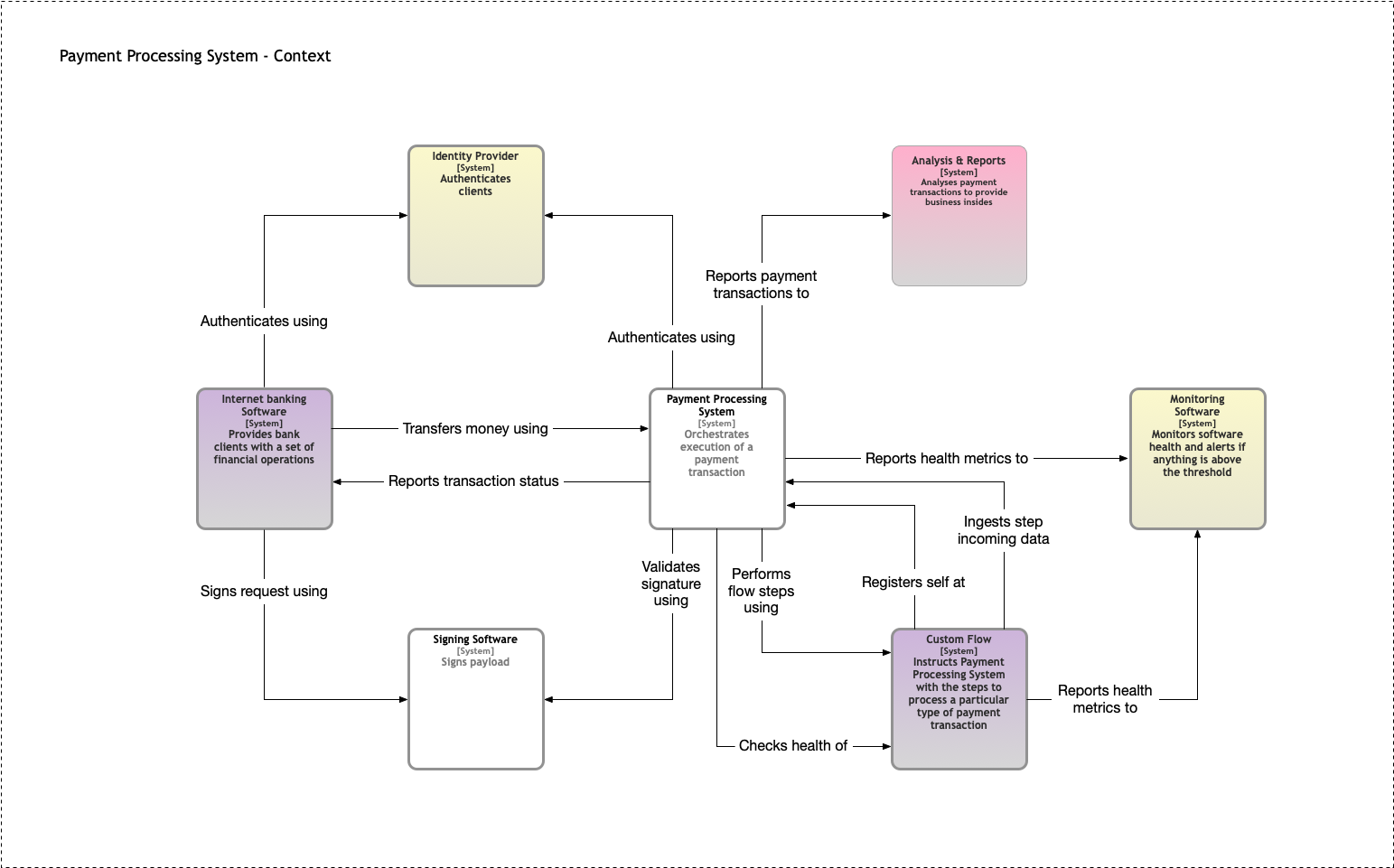

Concept

The Payment Processing System (PPS) is an engine and a framework to provide API for Mobile banking and process payment transactions between individuals, banks, and organizations.

In this case, the transaction capabilities are one of cornerstones behind system design and can represented like this:

-

step invocation,

-

retrying attempts in case of step failure,

-

and rolling back the whole transaction.

Flow

The framework enables software developers to implement transaction processing steps and compose them into a processing procedure called “Flow.”

-

The PPS engine provides HTTPS API to post payment transactions or get transaction details.

-

The API is intended for private usage inside the enterprise.

-

Bank software that needs transaction processing capabilities invokes the PPS engine’s API to process the transaction.

Readers familiar with Open Banking can consider the following example:

-

PPS runs behind the Account Servicing Payment Service Provider (ASPSP) API.

-

Payment Initiation Services Provider (PISP) negotiates payment consent and payment order with ASPSP API

-

ASPSP sends the payment order to PPS for asynchronous processing.