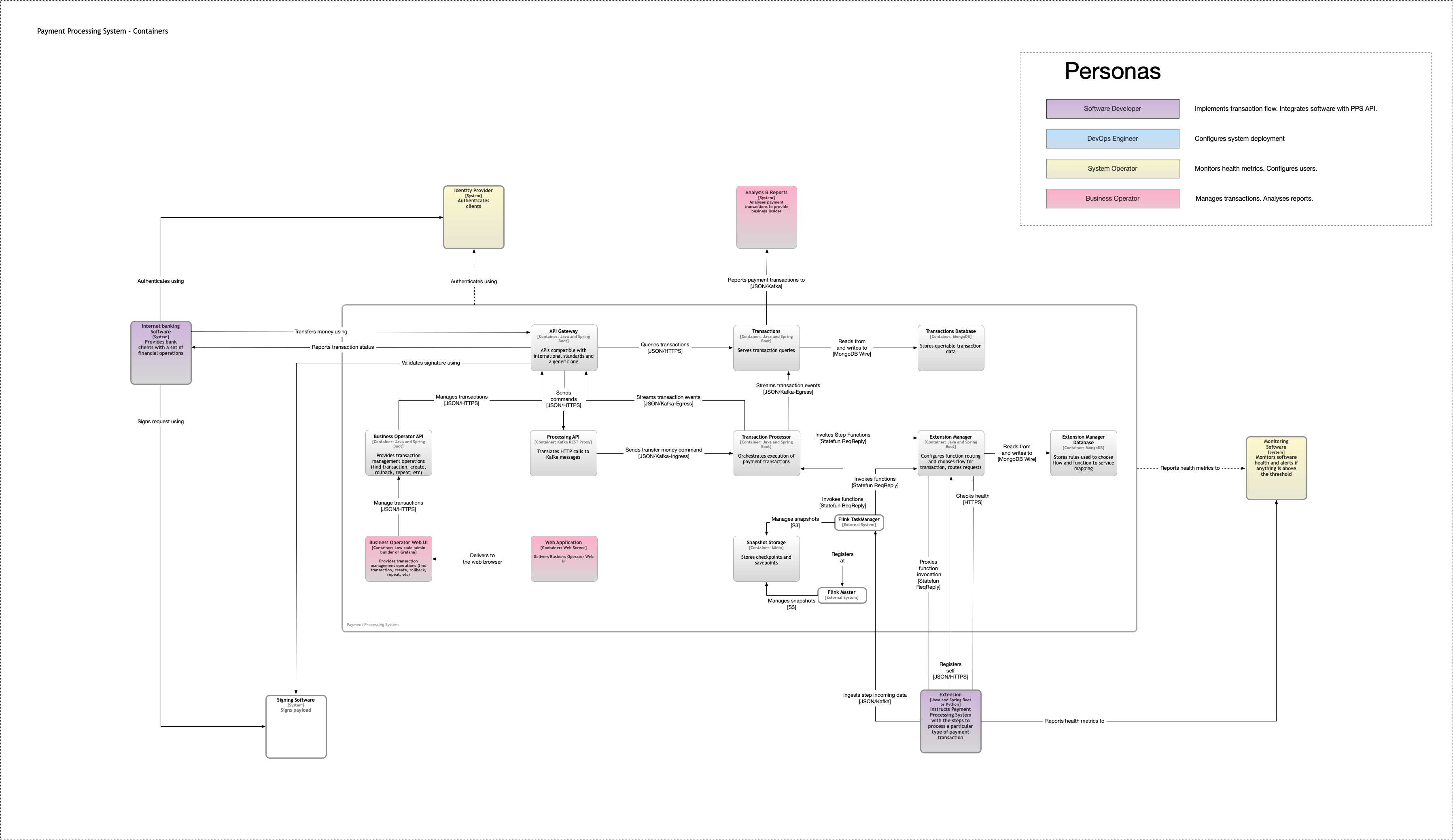

Architecture

Due to its nature design of the system is guided by critical quality attributes for the banking industry.

Securability

-

API Gateway integrates with the IdP of the enterprise to authorize requests to the engine.

-

Flink ingests commands via Kafka cluster that utilizes built-in security

-

Extensions protect their endpoints via OpenID

-

Extension Manager adds an access token to outgoing calls

-

Network connections are protected via TLS

Reliability & Availability

-

The engine continues to accept payment initiation requests for further processing even if Flink is unavailable

-

If Transaction Processor, Extension Manager, or any extension is unavailable, Stateful Functions runtime retries requests until success

-

If Transactions service is not available, it does not miss any progress events due to PubSub between Flink and itself

Interoperability

-

The engine provides API over HTTPS to initiate a payment transaction or query transaction data

-

The engine provides API over HTTPS for extension self-registration

-

Engine APIs published as OpenAPI documents

-

Engine APIs preserve backward compatibility

-

It’s possible to provide OpenBanking or ISO 20022 compatible APIs as well as any other API via custom adapters for the engine API

Observability

-

All components have health metrics available for the bank operators and injectable into an enterprise-wide dashboard

-

All components support structured logging and redirect logs into central log management solutions

-

Transaction statuses and error codes are observable via a Business Operator Web UI